Outside Of North America, Hotel Industry Recovery Is Sporadic

While the recovery varies widely, global hotel performance has shown signs of improvement across most world regions. From roadmaps to reopening across Europe to travel bubbles between key Asia Pacific markets and the overachieving Middle East in between, most of the world’s hoteliers have started to finally see the light at the end of the tunnel. Even South America, which, like Europe, sits a bit behind the rest of the pack, has found some strength in an unexpected hotel type this month.

Europe

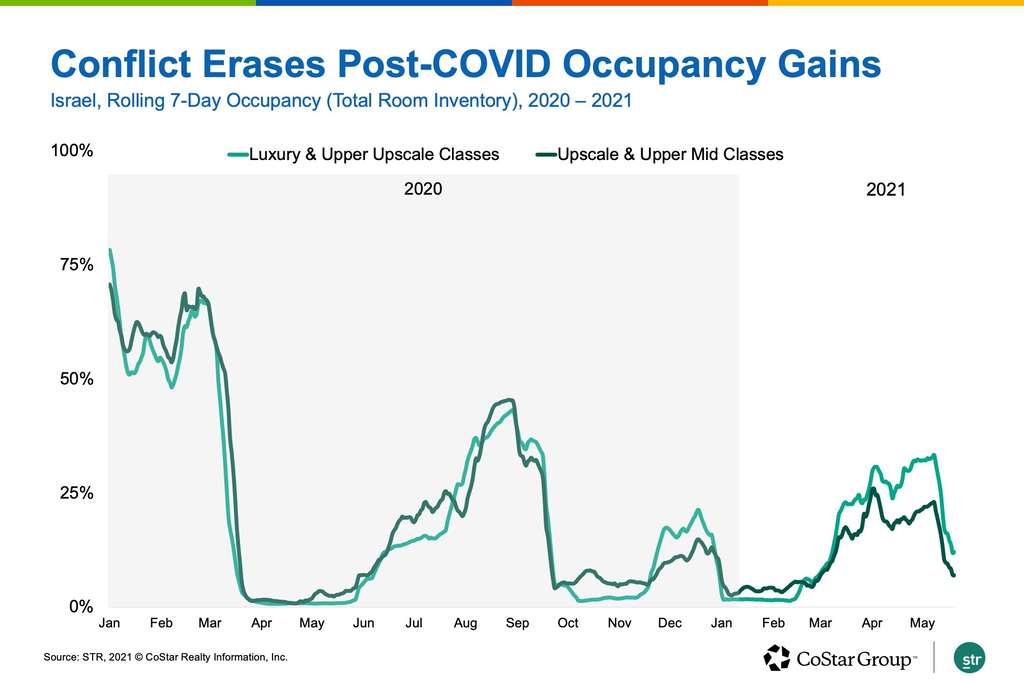

The Israeli-Palestinian conflict began just as the COVID-19 threat started to recede.

After a successful and lauded vaccination rollout, restrictions started to ease and hotel performance improved. When the United Kingdom released its “green list” of countries from which inbound travel will be accepted, Israel was one of 12.

Photo: STR

However, due to the Israeli-Palestinian conflict, Israel hotel occupancy has nosedived as safety concerns drive would-be visitors to other destinations. A ceasefire announced late last week ended the immediate violence, but with no real long-term changes implemented, the existing tensions that led to 11 days of war remain in place and pose a significant downside risk to hospitality recovery.

Middle East

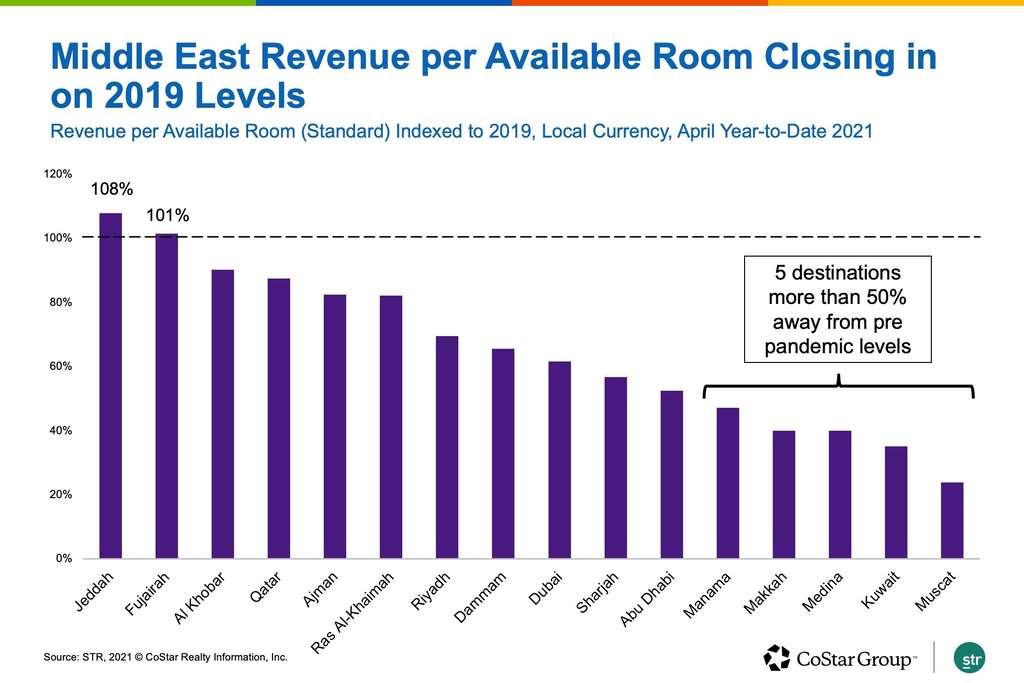

While borders remain closed in many Gulf countries, a number of key Middle Eastern destinations are reporting enviable year-to-date revenue per available room indexes, buoyed by long-stay (Qatar), domestic (Al Khobar), and/or leisure (Jeddah) demand. The under-performers — Manama, Makkah, Medina, Kuwait and Muscat — are missing key sources of demand.

Photo: STR

For Makkah and Medina, Umrah pilgrims’ absence is keenly felt; and Manama, Kuwait and Muscat are capitals of small, border-closed countries with lockdowns of varying intensity and relatively little domestic demand.

Asia-Pacific

Further East, travel bubbles have started to pop up, pause and reopen between a handful of destinations in the Asia Pacific region, including China and two of its Special Administrative Regions — Hong Kong and Macau.

During the worst of the pandemic, all forms of travel between mainland China and the regions halted, as each market closed its borders. However, the mainland remains a huge source market for Macau and Hong Kong, prompting the small, island-like regions to work towards reopening borders to mainlanders and each other.

Photo: STR

Macau reached the milestone first and eased restrictions on May 5. Occupancy skyrocketed, reaching nearly 81% on a rolling-seven-day basis before moderating somewhat. Hong Kong opened a one-way corridor, allowing residents returning from the mainland or Macau to forego quarantine, but a true bubble remains out of reach due to Hong Kong’s relatively high COVID-19 caseload.

Welcoming mainland China guests has allowed Macau to bounce back, but the tiny territory still trails the mainland in occupancy recovery.

Central and South America

Brazil and much of South America are once again struggling with new waves of COVID-19, due in part by a slow vaccine rollout, sporadic or unofficial lockdowns and the onset of winter. As one of the last world regions impacted by COVID-19, Central and South America trail many other world regions in recovery, with current conditions most similar to Europe a few months back.

One interesting trend does stand out, however. Unlike most of the rest of the world, mega-hotels in Brazil are actually leading occupancy recovery. The sample is admittedly small, but sample is not the primary reason for the discrepancy here.

Photo: STR

While in other nations, mega-hotels may be conference or convention hotels, reliant on business and group demand to fill their rooms, Brazil’s mega-hotels are almost entirely resorts, relying on the transient leisure traveler who is, has been and likely will continue to be out and about.

Positive signs abound in the most recent data, as vaccine rollouts and warm weather across parts of the world lend optimism to a wearied industry. With countries around the world beginning to lift restrictions and open their borders, many markets can expect improved performance over the coming weeks and months.

Kelsey Fenerty and Letizia Rossi-Espagnet are research analysts at STR.

This article represents an interpretation of data collected by STR, CoStar’s hospitality analytics firm. Please feel free to comment or contact an editor with any questions or concerns.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for global hospitality sectors. Founded in 1985, STR maintains a presence in 15 countries with a corporate North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com.